In the lead-up to COP26 in Glasgow, Scotland, the World Bank (International Bank for Reconstruction and Development, IBRD) launched an initiative to raise awareness with investors about its activities to mainstream climate action. A press release on September 23 announced a target to raise US $10 billion in World Bank Sustainable Development Bonds as part of the initiative, which highlighted the World Bank’s Environmental, Social, and Governance (ESG) policies and its role as the largest multilateral financer of climate action in developing countries.

Activities associated with the initiative explained how the World Bank integrates climate and sustainability throughout all its operations and across all sectors. World Bank bonds have the label “Sustainable Development Bonds” to communicate that the proceeds support the financing of a mix of projects that address climate action alongside other social goals. During the launch phase of Sustainable Development Bonds, the World Bank emphasizes the intentional impact and sustainability focus of all its activities while highlighting the Sustainable Development Goals (SDGs). This holistic approach focuses on transparency for all activities and is underpinned by impact reporting for investors.

Investor Engagement

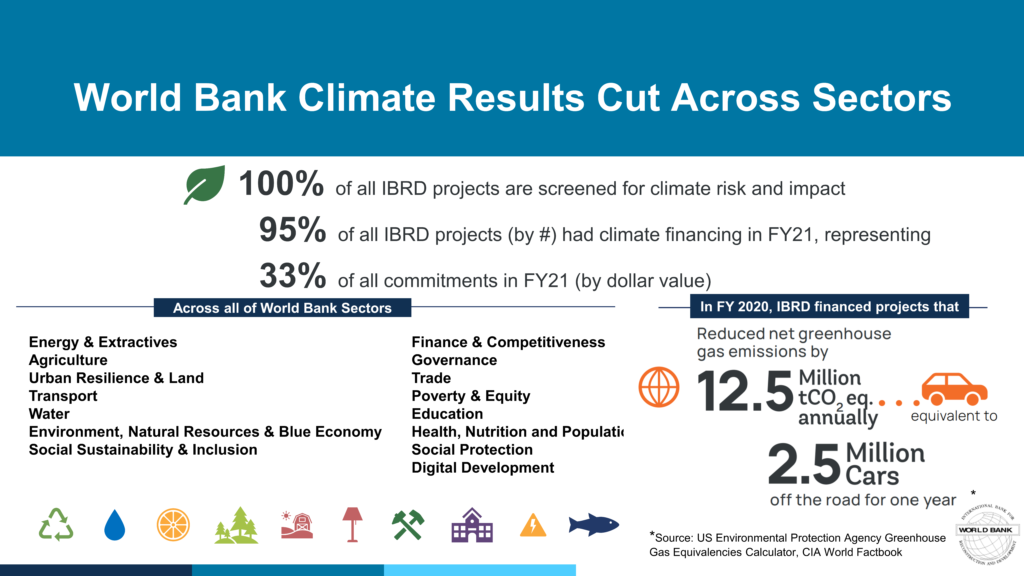

There was tremendous interest from investors to learn more about the World Bank’s approach to integrate climate action into all its operations. Based on reverse inquiry, nearly 75 virtual one-on-one investor meetings were conducted. Investors expressed strong interest to learn more about the World Bank’s updated Climate Change Action Plan and its “whole of economy” approach to support developing country clients in incorporating climate mitigation and adaptation into their national planning. In addition to one-on-one investor engagement, several virtual investor workshops and a “net-roadshow” pooled together groups of investors and other capital market stakeholders in different time zones, enabling the World Bank Treasury and climate teams to reach over 250 investors and other market stakeholders. Technical specialists from the World Bank’s Climate Change Group participated in these virtual discussions to share World Bank’s experience. Investors were particularly interested to learn how the World Bank screens for climate and disaster risk in 100% of its investments, and the process it has used to incorporate climate action components in 95% of its projects in Fiscal Year 2021, which accounted for 33% of all financing committed.

Issuance

The World Bank executed five benchmark and larger issuances and numerous smaller transactions associated with the initiative raising over US $12 billion equivalent. In total, the transactions associated with the initiative attracted over 300 investor orders from around the world for bonds denominated in Australian dollars, New Zealand dollars, Euros, and US dollars fixed rate and US dollars linked to SOFR index, as well as smaller transactions in several emerging market currencies. The funding supports financing of World Bank projects in developing countries which integrate climate considerations and developments to build greener, more sustainable economies. This funding forms part of the World Bank’s overall issuance program for Fiscal Year 2022.

Online Resources

The World Bank shared online resources to explain its holistic approach towards sustainability and climate. A feature story What You Need to Know About Sustainable Development Bonds was posted as part of the World Bank’s Climate Explainer Series which highlights the World Bank’s plans, policies, and tools for fighting climate change.

A video supported the initiative and was shared with investors at different occasions to jump-start discussions. The video on World Bank Sustainable Development Bonds for Climate Action is published on the World Bank Treasury YouTube channel.

The initiative attracted several media stories including from Global Capital, World Bank to print $10bn SDBs highlighting climate action, and IFR, World Bank’s climate focus inspires interest for record 10-year.

Take-Aways

During the two-month initiative to raise awareness with investors about the importance of mainstreaming climate action, the World Bank team made the following observations:

- Investors were very appreciative of the direct engagement and discussions on climate change. Discussions ranged from approaches to mitigation, such as greenhouse gas accounting and carbon pricing, to best practice to incorporate adaptation and resilience into investments as well as the World Bank’s commitment to direct at least 50% of its future lending. Investors appreciated the clarification that all World Bank projects should be considered as addressing climate change because all projects are screened for climate risks and 95% incorporate climate financing components.

- Investor behavior is changing. Bond investors are increasingly looking to understand the environmental, social, and governance impacts of their investments, with many taking a more holistic, issuer-focused approach. Overall, they are looking to integrate ESG considerations across all investments and seeking greater opportunities for positive impact beyond labeled bonds. Their motivations vary.

- Having started with green bonds, many investors are embracing a more holistic view of sustainability. Green bonds are often a key entry point for investors when setting up an investment process that integrates transparency around ESG aspects; however, many investors are broadening their approach to incorporate green and social investment. Investors are growing their labelled bond portfolios by increasingly adding sustainability bonds that support both green and social projects. Other investors are going further to analyse the climate and sustainability impacts of the entire issuer, not just their labelled offerings.

- Discussions with investors were well timed with the developments from COP26. The Glasgow Climate Compact committed signatories to double adaptation finance, a priority in the World Bank’s Climate Change Action Plan. Other announcements in Glasgow for countries to cooperate on methane, deforestation, and coal transition highlighted the importance of a holistic approach to green financing that incorporates social and climate considerations.

More Information

Visit www.worldbank.org or World Bank Climate Explainer Series

First published by World Bank in Dec 2021

Net proceeds of the bonds described herein are not committed or earmarked for lending to, or financing of, any particular projects or programs, and returns on the bonds described herein are not linked to the performance of any particular project or program.

This document is not an offer for sale of bonds of the International Bank for Reconstruction and Development (“IBRD”), also known in the capital markets as “World Bank”. Any offering of World Bank bonds will take place solely on the basis of the relevant offering documentation including, but not limited to, the prospectus, term sheet and/or final terms, as applicable, prepared by the World Bank or on behalf of the World Bank, and is subject to restrictions under the laws of several countries, including under the laws of New Zealand and New South Wales (Australia). World Bank bonds may not be offered or sold except in compliance with all such laws.