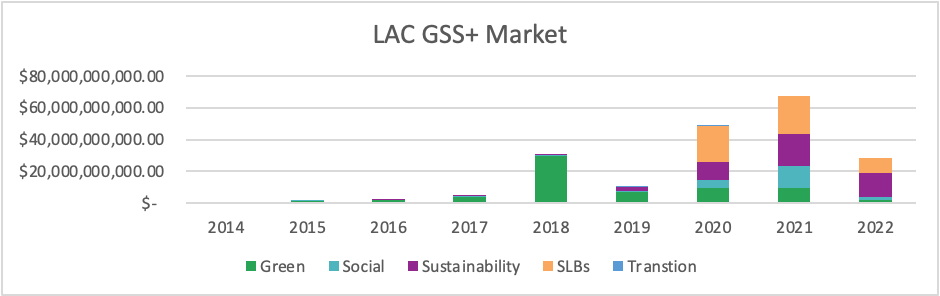

Globally, the cumulative total labelled (including green, social, sustainability, and sustainability-linked) issuance reached USD3.3tn in H1 2022, according to the Climate Bonds Initiative database. Even though Latin America and the Caribbean (LAC) region poses an enormous potential, it still represents less than 2% of the total global value. The first issuer from LAC entered the market in 2014, the Peruvian Energia Eolica’s USD204m deal to finance the construction of two wind farms in north-western Peru and since then, LAC’s market has more than doubled Prospects for GSS+ growth in the region remain positive.

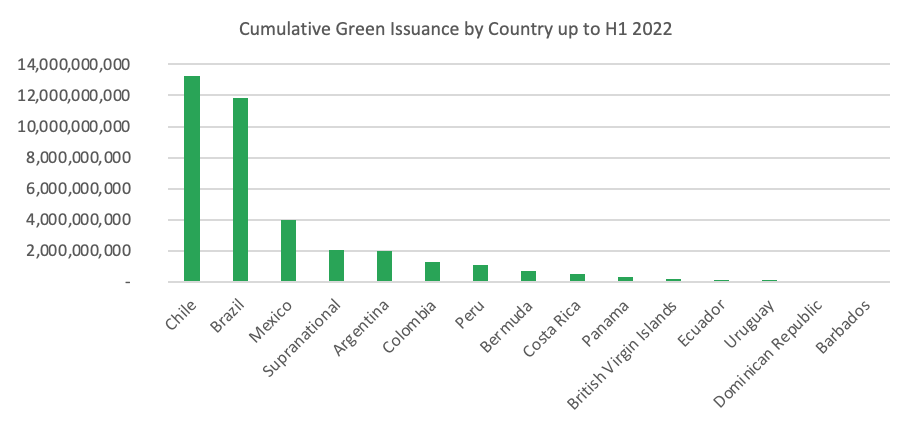

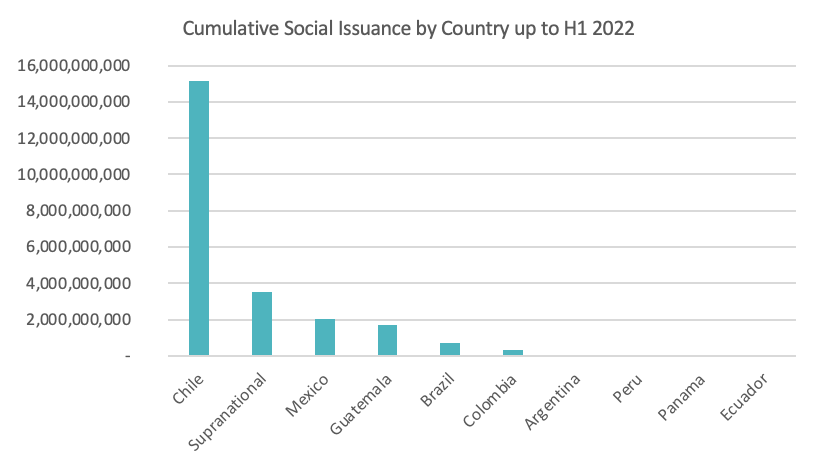

Since 2014, issuers from Brazil, Chile and Mexico dominate the labelled thematic bonds market in LAC. Mexico, Colombia and Chile rank first in social, sustainability and ESG issuances.

The development of LAC capital markets in recent years settled the ground for more debt issuances by both companies and governments and increased opportunities to investments in green projects coming from these Emerging Markets. Economic, environmental and social crisis became pressing issues in the region, calling for urgent and necessary capital deployment, particularly in the context of sustainable infrastructure development. Transitioning to a green and climate-resilient economies in the region is crucial to ensure that Latin American countries can reduce their GHG emissions, better hedge against climate risks and thrive in the long run. Thematic bonds could be an important instrument to support this transition. Amongst the green label, the most mature in the region proceeds allocations are mainly directed to the Energy, Industry and Land Use sectors.

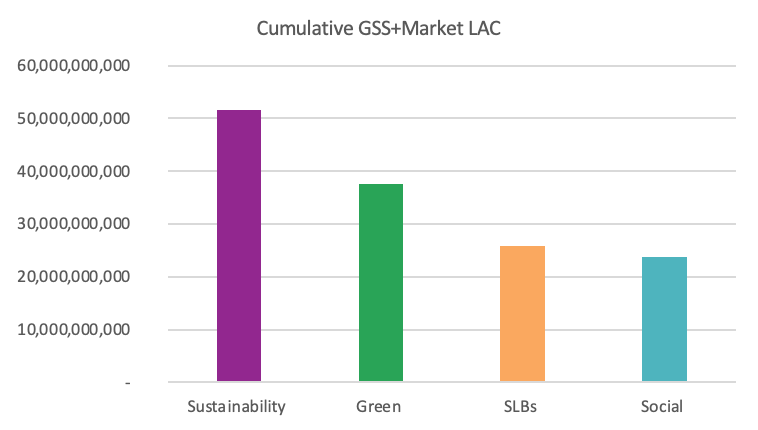

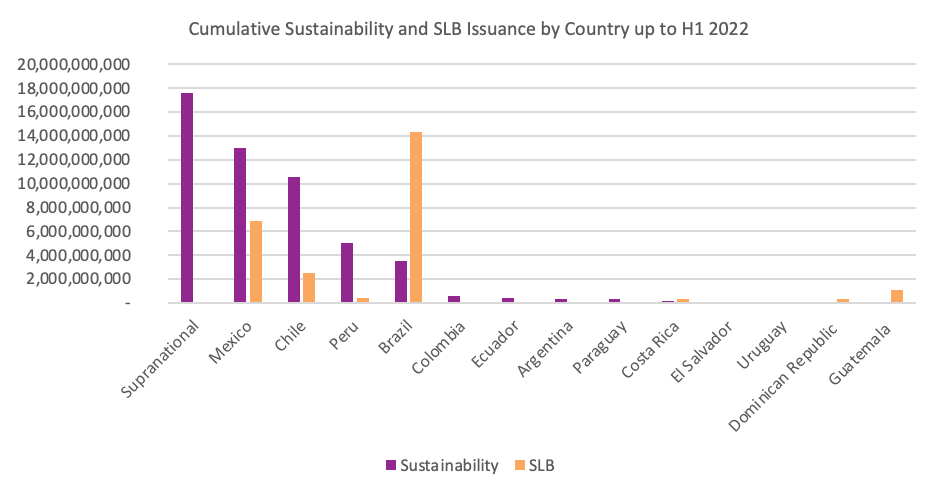

The latest figures from the Climate Bonds Initiative point to a cumulative USD138.4bn in GSS+ issuance from LAC countries. The sustainability label is the most prominent in the region (USD 51.5bn), followed by green (USD37.5bn), sustainability-linked (USD25.8bn) and social (USD23.6bn).

Green

Global annual green bond issuance reached the half trillion mark for the first time, ending 2021 at USD522.7bn. After the COVID-19 socio-economic crisis worldwide, private sector issuers returned to the green bond market in force with a notable growth from emerging market (EM) financial and non-financial corporate issuers. In the Latin America and Caribbean (LAC) region, volumes accounted for USD8.2bn worth of deals from 36 issuers and LAC sovereign green bond volume in 2021 was entirely supplied by Chile, a USD1.2bn operation. In 2022, the number of issuances decreased to USDD1.7bn by H1 2022 with non-financial corporates from Argentina (USD766m) and Brazil (USD397m) representing more than half of issuance volume. While there has been a decrease in the green label, there has been greater diversification to other themes such as sustainability and sustainability-linked.

Social

The social theme (excluding China) contributed 20.5% to total GSS+ all regions’ volumes in 2021. The LAC region showed the most impressive development, growing by 338% YOY to USD11.5bn, mainly coming by sovereign issuers: USD9bn from Chile which represented 80% of the region’s market and Peru contributed 10% of the total, a USD1bn deal.

Chile led the way for sovereign social spending in 2021, as the EUR and USD denominated issuance in July 2021 was the largest social Government-backed entities issuance bond operation in the country’s history, and included the longest tenors issued by the Republic. The proceeds of Chile’s social bonds were destined to support low-income families, the elderly and other vulnerable groups, as well as provide funding for education, employment, affordable housing, healthcare and food security. On the Peruvian deal launched in November 2021, the country debuted a 15- year social bond issued in EUR, raising funds for 2021/2022 budget funding to support education, essential health services, housing and SMEs.

In 2022, the number had a decrease compared to the previous year, with Mexico as the largest social bond issuer with a total USD1.1bn. The social label should continue to get traction in the region due to the many social challenges that need to be tackled.

Sustainability and Sustainability-linked

GSS+ debt markets are growing rapidly worldwide in an attempt to fund the low-carbon transition, with an increase in sustainability and sustainability-linked bonds. Most recently, there has been an increase under these two themes in the LAC region.

Sustainability

In 2022, Sustainability issuance reached USD15bn, with Mexico (USD5bn) and Chile (USD4bn) as the largest markets in LAC. Sovereign issuers represented 33% of the total issuance up to H1 and non-financial corporates 31%. In the beginning of the year Chile issued a USD4bn sustainability sovereign, leading this type of issuance under the sustainability theme. Comisión Federal de Electricidad, from Mexico, did the two largest non-financial corporate issuances of USD1.2bn each. Proceeds were allocated towards Energy, Building, Transport, and ICT.

SUSTAINABILITY-LINKED BONDS (SLBs)

However, the transition is not yet being delivered at sufficient scale and pace to achieve the goals of the Paris Agreement. The transition and SLB markets went from strength to strength in 2021, with the SLB market expanding by 941% to a total of USD135.0bn. At the end of 2021, SLBs comprised 4.8% of the GSS+ market, up from 0.9% share in 2020.

Chile’s USD2.0bn sovereign SLBs tied to the country’s GHG emissions and Renewables Installed capacity was issued in early 2022. Their GHG emissions targets are derived from Chile’s Nationally Determined Contributions (NDCs) to the Paris Agreement, and its renewables targets aims targets a majority (50%) by 2028, and 60% by 2032. This issuance served as an ambitious example of a sovereign SLB for other countries in the region. In H1 2022, Mexico debuted its sovereign sustainability (SDG) issuance worth USD981m and Uruguay prepares its first sovereign SLB issuance based on the framework published to tie interest rates to lower greenhouse gas emissions and preserve native forests by 2025 targets.

In H1 2022, the volume of SLBs issued in LAC reached USD6bn. Brazil and Chile appear as the two largest issuers, with USD2bn each from non-financial corporates. SLBs have been increasingly used by companies as it allows for greater flexibility in the use of resources, moving away from a use of proceeds model.

Growing the GSS+ Market in LAC

There have been recent movements to further support market growth and the expansion of a GSS+ pipeline with the creation of local taxonomies.

Taxonomies are classification systems to identify assets and projects eligible to receive financing in order to achieve a low carbon economy, as well as providing the definition of sectoral criteria to detect GHG emissions consistent with the global warming objectives established in the Paris Agreement of COP 21, the ground for determining the Nationally Determined Contribution (NDC) targets.

Colombia became the first LAC country to publish a green taxonomy in April 2022, which excludes all fossil fuels, including natural gas in the energy sector. In terms of defining sectorial criteria and activities eligibility, it was designed to be well aligned with the EU Taxonomy and promote the seven environmental objectives. An additional highlight was the contribution of the Land Use sectors (Agriculture, Forestry and Livestock) for adaptation and mitigation criteria and the incorporation of multiple environmental objectives simultaneously to ensure a holistic approach. Chilean and Mexican taxonomies are currently under development with the support of Climate Bonds Initiative. LAC has an increasing role to play in the GSS+ market. While issuances in 2022 have been timid compared to 2021, there is a need to scale investments in sectors such as low carbon energy, water, transportation and other critical infrastructure. Thus, the issuance of labelled bonds to fund such sectors are likely to increase in the coming years.

AUTHORS:

Leisa Souza, Head of LATAM, Climate Bonds Initiative

Sofia Borges, Sustainable Finance Officer for LATAM Climate Bonds Initiative