The growth of sustainable investing is fueling demand for financial products that incorporate ESG strategies as well as the evolution of frameworks that facilitate its growth.

Investment in ESG funds has reached an all-time high worldwide this year, powered by growing awareness of the risks of climate change and a pandemic that has highlighted both social inequality and the role of resilience in enabling companies to withstand sudden change.

In Europe, where between 41% and 57% of fund assets are projected to incorporate ESG strategies by 2025

In Europe, where between 41% and 57% of mutual fund assets are projected to incorporate ESG strategies by 2025, a series of disclosure requirements are slated to take effect that will require ESG funds and benchmarks to meet standards for sustainability.[1] In the U.S., one in three professionally managed dollars was managed according to sustainable strategies at the start of this year.

“ESG is becoming more concrete for investors and the public,” Véronique Menou, MSCI’s head of ESG index for the Europe, Middle East and Africa region, said recently in a discussion on MSCI’s Perspectives podcast. “I’ve been in the ESG space for more than 16 years now, and ESG has not always been that high on investors’ agendas.”

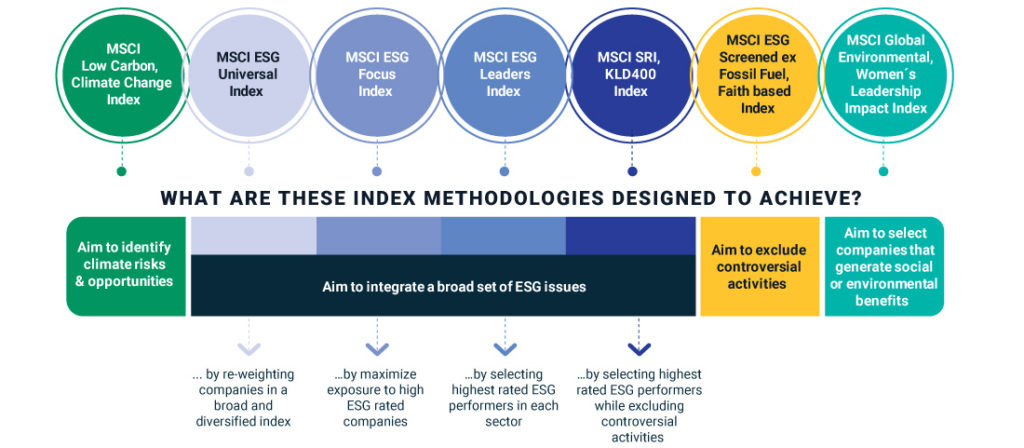

Though sustainable investing is growing around the world, differences appear across regions and approaches, according to Menou, who describes the latter in shades of green.

- A “light green” approach, as she terms it, aims to minimize headline risk and align portfolios with ethical or political values, via indexes, for example, that exclude companies associated with controversial weapons or tobacco, that rely on revenue from fossil fuels or that don’t comply with N. Global Compact principles.

- “Moderate-green” approaches aim to enhance risk-adjusted return, either by pursuing strategies focused on companies that have the highest ESG-rated performance in each sector or by selecting and weighting environmental, social and governance issues for each industry (the approach used in MSCI ESG Ratings).

- A “dark green” approach aims to generate measurable environmental and social impact — an approach that can be implemented by tilting the portfolio toward themes outlined in the U.N. Sustainable Development Goals.

Regulatory frameworks for ESG investing are multiplying and evolving toward a focus on end-investors, notes Menou, who served as one of 35 members of the European Union’s Technical Expert Group on Sustainable Finance (TEG).

The European Commission convened the TEG, which completed its work in September, to assist in developing the EU’s taxonomy for sustainable finance, together with an EU-wide standard for green bonds, methodologies for climate benchmarks, and disclosures and guidance to improve corporate disclosure of climate-related information.

Among the challenges was finding “the right balance between being too prescriptive and greenwashing,” says Menou, referring to the tendency by some companies to promote their operations or products as sustainable without support for the claim.

Menou cites as an example of striking that balance the TEG’s recommendationsregarding minimum standards that equity indexes must meet to be labeled as EU Paris-Aligned Benchmarks and EU Climate-Transition Benchmarks. Such indexes must target at least a 7% reduction in greenhouse gas emissions each year, among other requirements.

“When we assess the ESG performance of an issuer, what matters is not what they say they do, but rather what they do from a product or operations perspective,” Menou says. “From an index perspective, it is important to be transparent on both the index methodology and its output.”

Véronique Menou, MSCI’s Head of ESG index EMEA