The COVID-19 crisis has brought to light the critical role of investment promotion agencies (IPAs), who have had to demonstrate agility and reactiveness in supporting the needs of investors.

This is supported by UNCTAD data, which reports that 77% of national IPAs worldwide have provided COVID-related information and services and developed specialized virtual tools and platforms. For IPAs it has never been more important to remain close to our investor communities and key stakeholders in our exporting markets around the world, as well as to the businesses and sectors that we support.

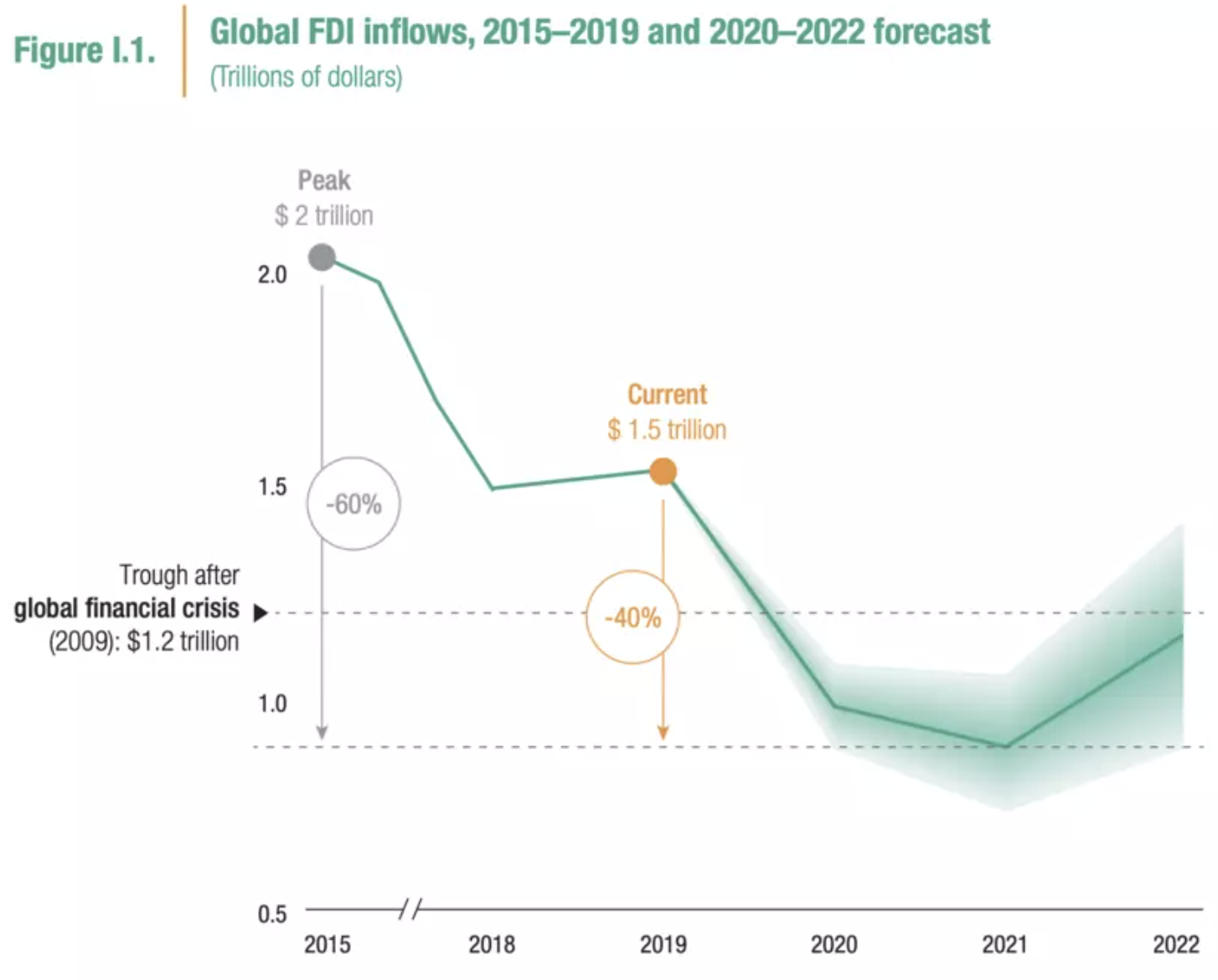

It is predicted that global foreign direct investment (FDI) activity may fall by up to 40% due to the economic crisis caused by the pandemic.

Investment promotion agencies (IPAs) around the world are demonstrating their criticality as we begin the recovery from COVID-19.

While that figure gives pause for thought and is clearly a bad knock for the global economy, it also reveals that there is still a lot of interest worldwide in pursuing the right FDI opportunities, and that investment activity, while reduced, will continue. Much as financial markets flock to gold as a haven in times of turbulence, we see FDI investors seeking to make smart investments in growth economies with long-term success potentia.

Rethinking FDI

Under the pandemic scenario, investors are seeking to maintain business as usual. IPA’s must completely rethink their FDI flows – how they maintain and even enhance that level of support and closeness to all our global stakeholders, wherever they may be. A greater emphasis must be placed on providing on-time intelligence to policy-makers, business leaders and entrepreneurs, while at the same time maintaining foreign investors’ confidence in our market in this period of heightened uncertainty, and continuing to connect them with the outstanding investment opportunities within the country we represent.

Market Intelligence tools that tracks different business indicators, including but not limited to exports and imports, in the context of the current crisis. Different interactive trackers allows both companies and public policy-makers to accurately trace the influence of the crisis on various sectors of foreign trade and the use of intelligence to develop solutions designed specifically to address investors’ biggest concerns.

Another key resource which must be tapped into is the global dynamism of start-up culture. For countries around the world, supporting and securing the short-term prospects and operational capabilities of small and medium enterprises (SMEs) and start-ups during this crisis is critical to developing this key growth segment and diversifying economies in the long-term

Such proactive measures are key if we are to mitigate the impact of the economic downturn caused by the pandemic, create more market certainty, and stem the worrying tide of investor flight.

Tools to help small businesses, micro-entrepreneurs and start-ups develop resilience and rebuild will be vital to continue to navigate the choppy waters of the crisis towards recovery.

Going digital

The crisis has also forced the workspace to go digital and along with many others IPA’s had to rethink and massively ramp up their digital capabilities, regularly promote videoconferences, online roundtables and other such webinars, connecting a wide cross-section of key stakeholders from each country and abroad.

Companies, sectors and industries must continue to invest in their digital capabilities in order to adapt to current and future challenges.

The focus of investment promotion agencies need to be stronger than ever to ensure that they maintain and develop their competitive edge when it comes to global investment. It has never been more important than in this time of unprecedented crisis. And that is why we will continue to redouble their efforts to help entrepreneurs, start-ups and business leaders engage with the global investment community and emerge even stronger and more resilient once this crisis passes.