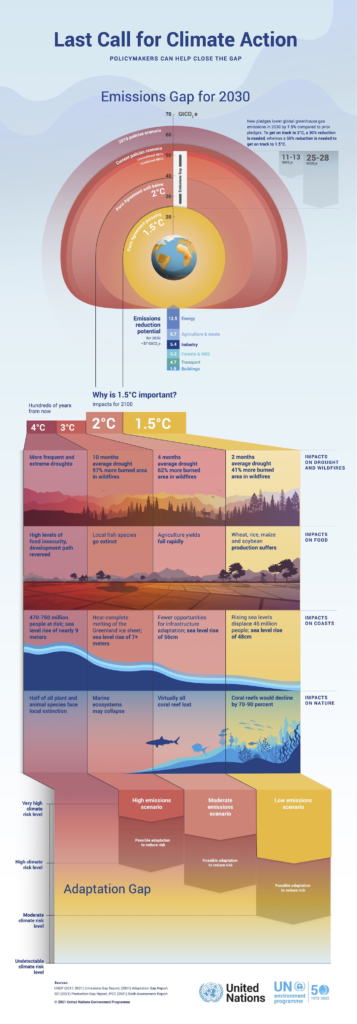

The climate crisis is at a crossroads. The three landmark reports issued by the IPCC in 2021 and 2022 highlighted the potentially catastrophic risks posed by climate change and the steps needed to preserve our planet for the future. The IPCC report also highlighted the unprecedented and coordinated global effort needed to tackle climate change – all sectors of our society have a role to play.

The impetus to reach net zero by 2050 is key to these efforts. Perhaps a (seemingly) distant target … but given the scale of the issue and its devastating impact, which is already being felt globally, we simply cannot afford to rest on our laurels. There are immediate issues linked to climate which pose a tangible threat to our security and stability right now. The unfolding global energy security crisis and the associated rise in the cost of living highlights the need to redouble our commitment to deliver on the transition to net zero.

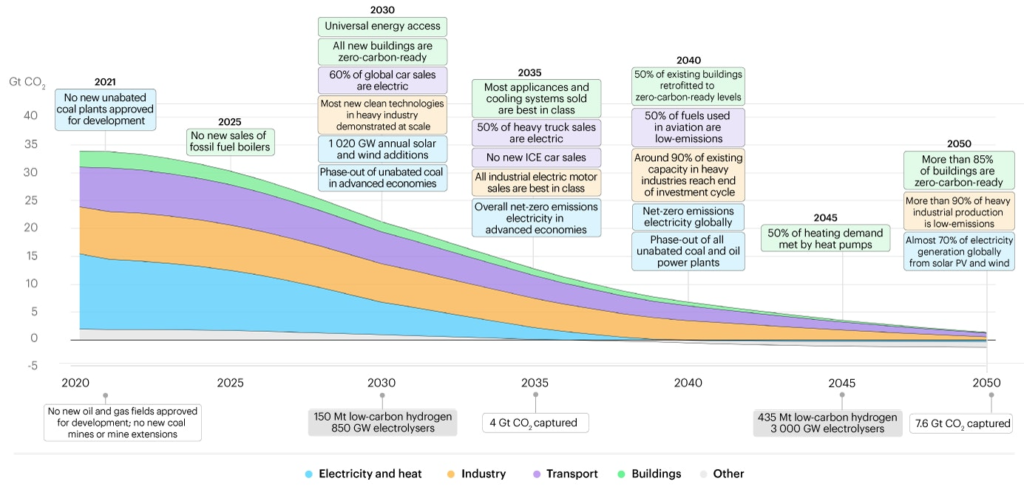

NET ZERO 2050 CHART

The IPCC’s report found that climate finance has a central role in facilitating this change. The good news is that we have both the technology and capital needed to close investment gaps and fund the green transition. This means that by 2030, the global economy could be firmly on the road to reaching net zero. However, for this to be reality investors need support. While there is undoubtedly still work to be done, there is also increasing appetite among the sector to align investment activity with the Paris Agreement goals – as clearly evidenced by the widespread adoption of the GFANZ initiatives for asset owners and asset managers and wider work being done across the sector. But for this change to be realised, investors need to operate within a supportive public policy sphere to ensure capital is allocated efficiently and that its impact is maximised. Finance can be an enabler or a constraint – investors and policymakers alike should strive for the former.

Investors are a key influence on policymakers and, therefore, their engagement on public policy is an important extension of these investors’ responsibilities and fiduciary duties. This engagement can take many forms. For example, the current consultation by the Securities and Exchange Commission on mandatory climate disclosure in the US is a measure which numerous responsible investors have pushed for, and which now needs the ongoing support of institutional investors to ensure its adoption. Notably the response to this consultation is a truly global one, involving not only investors headquartered in the US but also those with US holdings, with a view that the rules implemented in the world’s largest market have the potential to inform other standard setters around the world.

By working collaboratively, investors can amplify their voices and drive meaningful action most effectively. The annual Global Investor Statement to Governments on the Climate Crisis is an example of this. The statement, facilitated by The Investor Agenda initiative and supported by numerous investor groups, including the PRI, brings together investor voices to push for action on climate change. In 2021, the Statement was published in the lead up to COP26 and was signed by 733 investors with a combined total of US$52tn AUM. This was one of the efforts which influenced the SEC’s current consultation on climate disclosure, as well as feeding into wider policy discussion which took place at COP26.

Public policy and investment then are intrinsically interlinked on climate issues. To act most effectively, neither can operate in isolation. Investors should play an active role in policy engagement to and to help shape a policy landscape which is supportive of climate efforts. This is a core element of the process to drive effective and impactful capital allocation in aid of the net zero transition. And likewise, the policy sphere can and should lean on investors expertise and ability to allocate capital to deliver the change we so desperately need on climate issues.

What’s certain is that no group can solve the climate crisis alone. An unprecedented effort is needed to ensure that the risks are avoided. By working in union, both the investment and public policy spheres can form the core of a united and impactful global response to the dangers our planet faces.

Jodi-Ann Wang, Climate Policy Analyst, Principles for Responsible Investment