In recent years, the global and Latin American financial ecosystem faced unprecedented challenges and uncertainties. However, in the midst of a global pandemic – and in many cases in response to the gaps in societies exposed by COVID-19 – more and more investors globally and in Latin America have advanced in their understanding of environmental, social and governance (ESG) investing. Against this backdrop, the evolution and growth of responsible investment in the region is increasingly a reality.

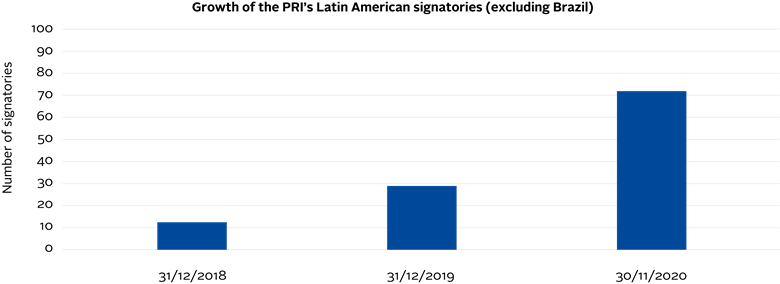

The growth of the Principles for Responsible Investment (PRI) highlights this trend, as we recently crossed the milestone of 4,000 signatories with more than USD 100 trillion in AUM, With over 90% of these signatories based in developed markets, it makes sense that leadership, new ideas, and the regulatory agenda comes from institutions based in those markets. But at the same time, it is important to consider that responsible investment is a global imperative and it’s gaining more relevance in Emerging Markets (EM) now. For instance, 9% of PRI’s signatories represent EM, they are also the fastest growing number of signatories, with Latin America and China leading the way.

2020: steady growth for responsible investment in Latin America

COVID-19 has accelerated interest in responsible investment in Latin America because investors want to:

- recover from the pandemic with a clear vision of how protecting human and natural resources will allow for more resilient and faster growth;

- promote the development of solutions that help to generate a positive impact, both socially and environmentally, to mitigate the effects of the current crisis, as well as prevent future ones.

Interest in responsible investment in the region began in Brazil in 2006 with the creation of the Sustainability Index (ISE), promoted by BM&F Bovespa, which gave a great boost to responsible investment in the Brazilian market. But it was not until 2017 that interest from organisations in countries such as Colombia, Mexico, Chile and Peru began to take off.

In these markets, more than 20 pension funds have become members of PRI, something which has marked a “before” and “after” for the growth of responsible investment in the region.

Challenges and opportunities do remain to fully embed responsible investment in the Latin American market:

- Ensuring that investors who have made commitments to implementing responsible investment really do progress in incorporating ESG factors in all the asset classes in which they invest. Otherwise, the region could fall foul of greenwashing, reducing the legitimacy of the work that has already been carried out;

- Helping PRI signatories advance in the implementation of ESG strategies in their investment processes;

- Working with the region’s stock exchanges, supervisors and central banks so that investors in Latin America have access to better ESG information, allowing them to incorporate these factors into investment decision making.

2021-2024 Key years for the consolidation of responsible investment in Latin America

This is a key moment for investors in Latin America. COVID-19 has made it clear that, although achieving economic results is fundamental (and will continue to be), ESG factors can positively or negatively influence the companies and projects in which investors are putting their capital. As PRI CEO Fiona Reynolds has noted, “We’re now seeing a shift from investors thinking purely from a risk-and-return standpoint to also considering their role in driving real-world outcomes.”

Talking about real-world outcomes PRI recently launched the new 2021-2024 strategy which was devised in consultation with signatories considering that the world is facing interrelated crises: the COVID-19 pandemic, environmental challenges including the climate crisis and the deepening of social inequalities. So this strategy is key to addressing these challenges.

In creating this strategy, it was clear to us that the external environment has evolved significantly since the purpose and mission of the PRI was originally conceived in 2006. Since then, we have seen the formation of the Paris Agreement and the Sustainable Development Goals, as well as an evolution in investor terminology, expectations and practices.

Therefore, investors in the region will be able to demonstrate in coming years through their decisions how they are helping to establish an economic model that prioritises social and environmental sustainability. In fact, it is a unique opportunity that provides a turning point to guiding capital flows towards sustainable development. The decisions and actions that are taken now can define the nature of the lives that Latin Americans will lead and retire into in the years and decades to come.