The growing need to combine prosperity with environmental, social and governance (ESG) considerations has already started transforming patterns of consumption, the political and regulatory landscape for businesses and the world of investing. Consumers, clients and investors are essentially calling on companies to take greater account of long-term externalities and to help preserve natural capital and finite resources. As a result, businesses across all sectors are seeking to create more sustainable business models that address the risks and leverage the potential of this transformation.

Credit Suisse has been a pioneer in the area of sustainable and impact investing for more than 17 years. Today, we continue to contribute substantially to the development of this market, as well as integrating broader societal trends into our products and services. Credit Suisse views finance not as an end in itself but rather as a means to realize ambitious objectives, and we strive to lead the way in supporting clients as they adapt their business models and join the transition to a more sustainable economic system.

Sustainable investments have more than doubled in volume over the last five years, and the volume of impact investments has increased at an even faster pace. We have seen an especially strong rise in demand for sustainable and impact investment opportunities from institutional investors. In addition, private clients – particularly high-net-worth individuals, next-generation investors and millennials – are increasingly expressing their desire to use their capital to have a positive impact on the world. At the same time, charitable foundations are looking for ways to align their investments with their mission.

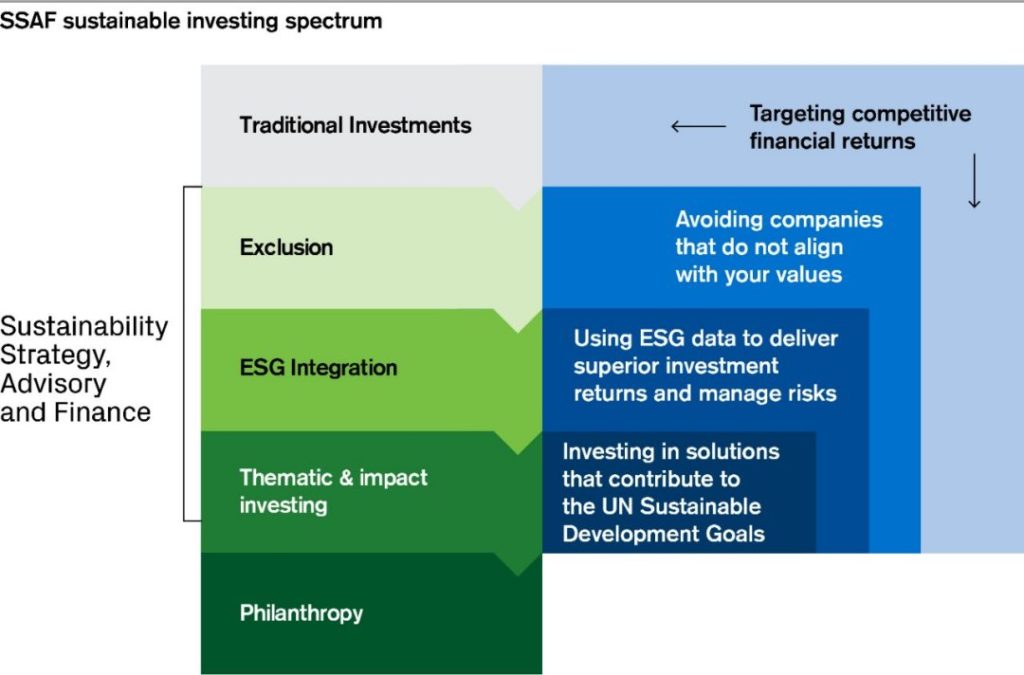

Sustainability Strategy, Advisory and Finance (SSAF) combines all of Credit Suisse’s investment activities in sustainable investing around the globe within one organization, while defining the firm’s sustainability strategy relating to these efforts. SSAF aims to facilitate investable projects and initiatives that have a positive economic and social impact while focusing primarily on generating a financial return for clients. Its mandate is to define, guide and coordinate all of the Group’s activities in this sector for the benefit of institutional, corporate and wealth management clients. Its mandate is to set the bank’s sustainability ambition and public commitments and be responsible for selecting the bank’s core sustainability themes. It will also determine flagship initiatives, divisional sustainability KPIs and lead the bank’s public profile on sustainability.

Sustainable Investment

Credit Suisse’s sustainable investment offering comprises portfolio solutions and products across a range of asset classes, including equities, fixed income, real estate, alternative investments, thematic investments and index solutions. We offer sustainable single and multi-asset solutions to private and profes-sional clients across different regions, constantly broadening and aligning them more and more closely with the applicable SDGs. We design solutions that aim to generate market rate or higher returns, by adding ESG factors to allow for better-informed investment decisions, while also reflecting our clients’ personal values and taking into account long-term externalities of their portfolios for people and the planet.

Our sustainable investment strategy considers ESG aspects in addition to traditional financial criteria. For single securities, we use a multi-strategy framework that allows our clients to translate their personal val-ues into investment decisions. This new framework was created by a group of Credit Suisse specialists with expertise in the fields of sustainability, portfolio management and asset management, as well as by the office of the Chief Investment Officer and SSAF. This group also regularly reviews the framework and suggests recommendations to align our approach with the latest industry developments.

Assets invested according to sustainability criteria at Credit Suisse rose to over CHF 44 billion by the end of 2019, reflecting continued growth in this area.

More information visit www.credit-suisse.com