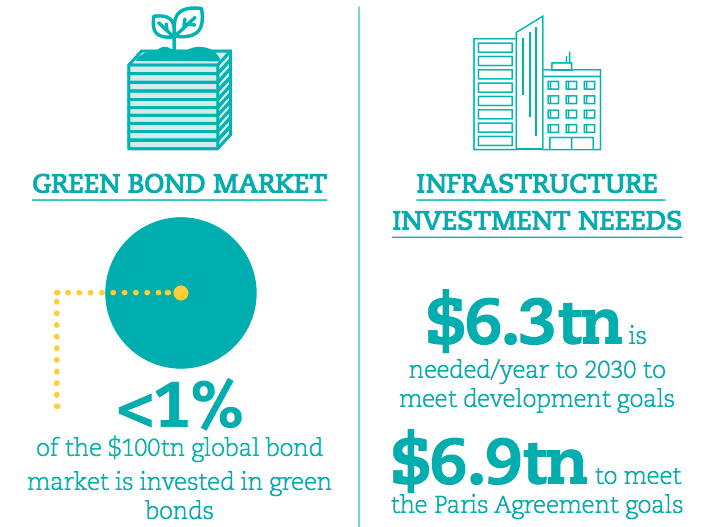

Good infrastructure is the backbone of any successful society and economy. People need access to energy, transport, sanitation, hospitals and schools to thrive. Unfortunately, the way we have built much of this infrastructure over the last century has been extremely carbon intensive. Worse still, we will need to build much more of it in the coming decades, particularly in emerging and developing countries. Unless we quickly develop a new generation of sustainable infrastructure, it will be very hard to reverse catastrophic climate change. This will involve significant investment, up to $6.9 trillion per year through to 2030 according to the OECD. Bringing private sector finance to the table is crucial.

This will involve significant investment, up to $6.9 trillion per year through to 2030

Many institutions have been engaged in mobilizing finance towards sustainable infrastructure: the G20, OECD, Multilateral Development Banks and the broader development finance institutions community; the Sustainable Development Investment Partnership (SDIP), the Private Infrastructure Development Group (PIDG), financial intermediaries, NGOs, and countless others have focused on this issue. Significant progress has been achieved. Guiding principles are emerging and a lot of innovation in blended finance has taken place over the years.

Yet progress has been slow to close an investment gap estimated to be in excess of $3 trillion a year over the next 10 years. The generation of bankable projects involving renewable power, green transport, sustainable water and waste, and green buildings is expanding but remains inadequate and sub-scale in the developing world. Financing of infrastructure projects is limited and lacking sufficient investment from the private sector. Institutional investors are keen to invest in sustainable infrastructure, which can offer stable, long-term returns. However, there is currently no way for them to verify which assets are genuinely sustainable.

That’s where the ‘Finance to Accelerate the Sustainable Transition-Infrastructure’ (FAST-Infra) initiative comes in. Its aim is to transform sustainable infrastructure into a mainstream, liquid asset class. To do this, it proposes to establish a consistent, globally applicable labelling system for investments in sustainable infrastructure assets. Through this labelling system, the market can easily signal the sustainability of the asset, and investors can trust that their money is going to projects that meet environmental, social, resiliency, and governance needs and contribute to the SDGs.

A sustainable infrastructure label will ensure that governments and project developers embed high environmental, social, governance and resiliency standards into new infrastructure at the design and pre-construction phases, on the grounds that only assets incorporating such standards will obtain the label. The label will also attract private finance at the construction stage and new institutional investors at the post-construction phase. Alongside the labelling work, FAST-Infra is developing financial mechanisms to mobilize private investment at scale for the financing of labelled projects.

FAST-Infra was conceived by Climate Policy Initiative (CPI), HSBC, the International Finance Corporation (IFC), OECD and the Global Infrastructure Facility under the auspices of President Macron’s One Planet Lab. In May this year FAST-Infra hosted two global roundtables to present its goals and to invite the key stakeholders in the infrastructure ecosystem to join. Close to 100 institutions participated, with most subsequently joining FAST-Infra, including leading global investors, financial intermediaries, development finance institutions, governments, rating agencies and other stakeholders.

The participants in FAST-Infra have been organized in three parallel streams that started work in July 2020.

Working Group 1: Establishing a sustainable infrastructure label that covers environmental, social and resiliency standards, governance and reporting.

Working Group 2: Upsizing successful projects, replicating them in other countries, and exploring ways to overcome barriers to private financing.

Working Group 3: Collaboration with national development banks and other emerging market financial institutions given the important role that domestic institutions play in infrastructure finance locally.

The working groups will provide reports on their progress in November this year, after which we intend to launch the FAST-Infra label into the real world. We’ll also be unveiling four pilot phase sustainable infrastructure projects that will serve as proofs of concept.

There are still questions to resolve over how best to move forward. For instance, with regards to labelling, the working group is considering whether it would be preferable to verify in-house through FAST-Infra itself, or to allow outside agencies to offer verification services.

That’s why we need as much stakeholder involvement as possible. We already have fantastic involvement from major financial institutions, asset managers and governments. But the more voices we have in FAST-Infra, the more we can work together to solve sustainable infrastructure finance challenges and make this initiative a success. Treat this blog as a call to action – if you are interested in sustainable infrastructure, if you are keen to develop an emerging asset class, and if you are conscious of the desperate need to do more to fight climate change, then please consider adding your energy to FAST-Infra.

In the long-term, this isn’t just about infrastructure. It’s about establishing a template for cooperation that can be applied to other asset classes and sustainable projects. The broad range of market participants don’t naturally work together – the lifeblood of our industry is competition, after all – but on this occasion I believe doing so will create an opportunity to generate economic growth and combat climate change.