- As investors increasingly incorporate climate change into their risk management, estimating its impact on issuers’ creditworthiness becomes an important ingredient.

- We investigated how different climate scenarios could impact the five-year default probability of a large sample of USD and EUR bond issuers.

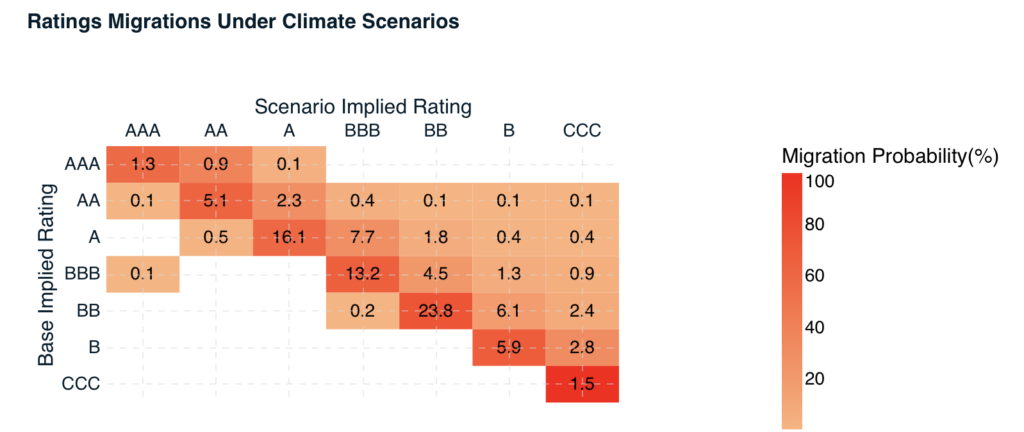

- Our analysis showed that 16% of the investment-grade issuers in our sample could be downgraded to high yield in a “Net-Zero 2050” scenario.

With the 2021 UN Climate Change Conference (COP26) approaching, financial institutions are increasingly focused on gauging the risks related to climate change. We investigated how various climate scenarios could impact the credit risk of portfolios. Our model-based analysis showed that, for a large sample of issuers of USD- and EUR-denominated bonds, about 16% of investment-grade issuers could experience a migration to high yield, while an additional 27% of the high-yield issuers could be downgraded under a “Net-Zero 2050 (Average Extreme Weather)” scenario.

With the “Climate Biennial Exploratory Scenario” published last June,1 the Bank of England set the trend in the assessment of climate-related financial risks, with other central banks following suit. As these stress tests are focusing on the banking book, credit risk from lending activities is the most important focus. Such credit risk is also relevant to other financial institutions that hold corporate debt, as climate change may cause rating downgrades and a corresponding widening in spreads. In this blog post, we explore how MSCI’s bottom-up climate scenarios can shed light on the impact of climate change on default probabilities and ratings migrations.

A Stress Test of Transition and Physical Risks

Our previous blog post discusses the variety of scenarios available for investors to assess climate risks. In this post, we explore three such scenarios for transition risk based on three Network for Greening the Financial System (NGFS) scenarios: “Net Zero 2050,” “Below 2⁰C” and “Nationally Determined Contributions.”2 The transition risk can be broken down into “Policy Risk,” resulting from more stringent regulation, and “Technology Opportunities,” for companies that could stand to gain from the green transition. We combine the “Net Zero 2050” and “Below 2⁰C” scenarios, which are more ambitious in terms of greening the economy, with an “Average Extreme Weather” scenario, and the “Nationally Determined Contributions” scenario with an “Aggressive Extreme Weather” scenario.3

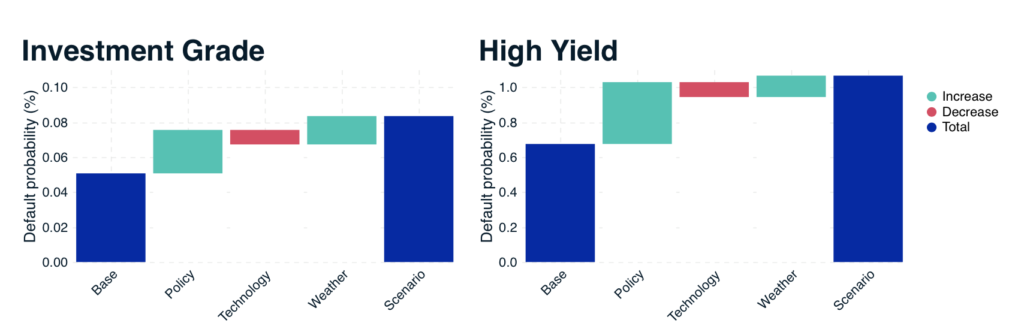

The interactive exhibit below illustrates how, for each of the scenarios, the median five-year implied probability of default (PD) changes and how each driver contributes to the change.4 For the sample of investment-grade (IG) and high-yield (HY) corporate-bond issuers we investigated, the changes in median PDs are relatively benign with increases of up to 0.03 percentage points for investment-grade issuers and 0.39 percentage points for high-yield issuers. Policy risk has the largest contribution for the “Net-Zero 2050 (Average Extreme Weather)” scenario, whereas extreme-weather risk is the main driver in the other two scenarios.

Contribution to Increase in Median Five-Year Default Probability

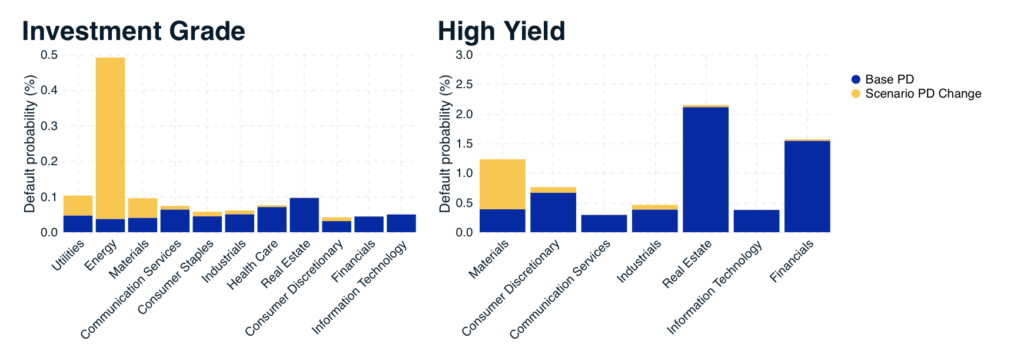

Transition-Risk Impact on Sectors’ Five-Year Default Probabilities

Source: Moody’s Analytics, MSCI

The analysis shows that under the “Net Zero 2050” scenario, around 16% of EUR investment-grade issuers could experience a migration to high yield, and 30% EUR high-yield issuers, could be downgraded.

Ratings Migrations Under Climate Scenarios

As investors increasingly incorporate climate change into their risk management, estimating its impact on credit portfolios becomes an important ingredient. Our analysis showed that default probabilities slightly increase on average; but more importantly, 16% of the investment-grade issuers could migrate to high yield, and an additional 27% of high-yield issuers could be downgraded, potentially putting downward pressure on portfolio returns.

The authors thank Andras Rokob for his contributions to his blog post.

More information visit www.msci.com

Reka Janosik

Vice President, MSCI Research

Thomas Verbraken

Executive Director, MSCI Research